Gatekeepers of the New Baseline

GLP-1 drugs, longevity, and the real cost of controlling human metabolism

☕🌴 Hi everyone, this is Andrii, and you are reading my brand-new newsletter, Molecules & Empires. You received it because you subscribed or someone forwarded it to you.

In this newsletter, I’ll be sharing reflections on emerging ideas in science and technology: how societies change, how power accumulates, and how certain futures quietly take shape. Molecules will show up sometimes, but mostly as a prerequisite for talking about something bigger.

Some issues will be quite technical, others more generalist and strategic; some will be speculative and futuristic, others more down-to-earth. We’ll see how it goes.

Today, I would like to take on a topic that has been on my mind for almost a year: the “wild west“ of weight loss drugs, the rise of new pharmaceutical empires, a potentially much bigger future for GLP-1 receptor agonists as the first longevity drug category at scale, and also emerging and growing risks and what it all means for society.

Off we go. Hope you enjoy it!

— Andrii

“It’s not just about the weight you lose, it’s about everything you gain” — Novo Nordisk

This was one of the ad campaign slogans promoting Wegovy, one of the drugs from a new revolutionary class of weight-loss medicines, based primarily on GLP-1 receptor agonists. These molecules mimic a natural hormone that regulates appetite in the brain.

Few people expected this, but weight-loss drugs are on track to become the biggest-selling drug class in medical history.

Analysts from major banks (Goldman Sachs, Morgan Stanley, BofA) project the global GLP-1 market could reach $100–150 billion annually by the early 2030s.

If the trend keeps its pace, GLP-1s would surpass sales of statins at their peak, all oncology blockbusters as a class, and HIV antivirals.

In 2023–2024 alone, GLP-1s generated tens of billions in annual revenue, with growth rates still extremely high.

Sales of GLP-1 receptor agonists helped Denmark-based pharma giant Novo Nordisk become Europe’s most valuable public company and contributed an estimated 1–1.5% of Denmark’s GDP growth in a single year (2023).

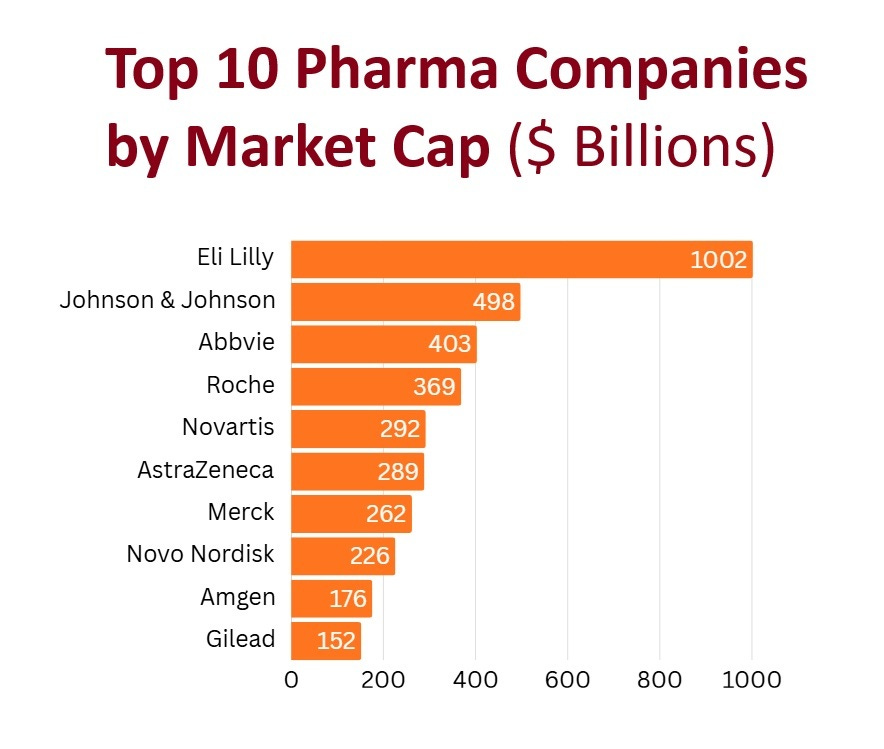

In parallel, US-based drugmaker Eli Lilly rode the same drug class to a market capitalization of more than $1 trillion — the first and only pharma company in history to do so.

Beyond market leaders, there is a growing number of other players, big and small, trying to catch a piece of the cake… Amgen, Roche, AstraZeneca, Viking Therapeutics, Boehringer Ingelheim / Zealand Pharma, etc.

Within three years of Wegovy’s approval in 2021, GLP-1 drugs reached tens of millions of users globally, and the trend is rapidly growing. For instance, by 2025, nearly 12% of Americans had used a GLP-1 weight-loss drug at least once, according to surveys, while in the UK, an estimated 1.6 million adults reported using weight-loss medications in the previous year

Astonishingly, GLP-1s are already crossing species boundaries. San Francisco–based Okava Pharmaceuticals has launched a pilot study testing a six-month GLP-1 implant for obese cats, signaling potential expansion of GLP-1s beyond human medicine into veterinary metabolic health.

None of this was supposed to happen. I am pretty sure executives at Eli Lilly or Novo Nordisk had little idea a decade ago about the magnitude of what was about to unfold…

Why are weight loss drugs such a big deal?

First, let’s zoom out for a moment: what are GLP-1 receptor agonists?

Most notable names on the market include injectable drugs Ozempic and Wegovy (based on the chemical compound semaglutide, developed by Novo Nordisk) or Mounjaro and Zepbound (based on a different compound, tirzepatide, developed by Eli Lilly). Oral formulations are now moving through approval and launch pipelines to further expand reach.

This drug class acts on the incretin system, a hormone signaling network centered in the gut. The incretin system links food intake to insulin release, appetite regulation, gastric emptying, and energy balance by coordinating communication between the intestine, pancreas, and brain.

GLP-1 drugs were originally developed to manage type 2 diabetes. What they revealed instead was a lever on human metabolism so powerful that it reshaped appetite, body weight, cardiovascular risk, and disease progression all at once.

Clinical trials showed average weight loss exceeding 15%, up to a 94% reduction in progression from prediabetes to diabetes, and a 20% drop in major cardiovascular events—results strong enough to move GLP-1s from endocrinology into the center of modern medicine.

The effects were obvious almost immediately. People felt less hungry within days. Weight dropped within weeks. Blood markers improved within months. By 2024, an estimated 15 million Americans were using a weight loss drug, many without diabetes, often paying cash, often navigating shortages because global supply could not keep up with demand. Marketing was following a strong biology signal…

A few years ago, weight-loss drugs “lived” in clinics and pharmacy queues. Today, they show up in places that don’t look medical at all.

Due to intense hype, these drugs are [frequently marketed on social media](https://www.edweek.org/leadership/weight-loss-drugs-are-the-talk-of-social-media-and-teens-are-listening/2024/03#:~:text=Commentary may contribute to girls,self-esteem and mental health.) (e.g., TikTok, Instagram) as “quick-fix” solutions, rather than treatments for chronic disease, driving demand for “beach-body” ready results.

They appear in subscription flows that resemble streaming services… Telehealth companies, for instance, have adopted the user-friendly, recurring-payment structures typically seen in services like Netflix or Spotify, to manage high-demand medications like Wegovy and Zepbound. Just one example of many, a company Hims & Hers, offers weight-loss programs for the price of a mid-range gym subscription for compounded GLP-1 injections, bundled into what they advertised as a ‘seamless’ online experience that includes unlimited consultations.

Weight loss drugs start arriving through telehealth checkouts, sometimes without a long-standing relationship with a physician. They are framed as maintenance, prevention, or simply “something people are on.”

This shift from medicine to lifestyle phenomenon is visible in how the market now talks about access to weight loss drugs.

Executives increasingly compare GLP-1 medications to everyday consumer goods—something you sign up for, manage through an app, and fit between the gym and dinner. That framing would have been unthinkable when these drugs were positioned narrowly as treatments for type 2 diabetes, in earlier years!

Advertising reflects the same drift. Much of the messaging avoids disease language entirely. Instead of obesity or diabetes, it emphasizes energy, confidence, control, or simply “feeling like yourself again.” In the United States, this framing also allows intermediaries to market aggressively without triggering the stricter rules that apply to direct pharmaceutical advertising.

The result is a subtle inversion. GLP-1s are no longer introduced into life as an exceptional medical intervention. They increasingly appear as a background option—something available, discussed, and normalized long before a doctor’s office enters the picture.

To be fair, we have seen medicine move into everyday lifestyle before…

When sildenafil was approved in 1998, Viagra entered the market as a treatment for erectile dysfunction, yet its cultural impact quickly exceeded that diagnosis. It became one of the first prescription drugs marketed directly to consumers at scale in the United States, framed around confidence and quality of life rather than disease. But still, its use remained episodic: taken as needed, producing temporary effects, and leaving baseline physiology unchanged once discontinued.

The oral contraceptive pill marked a deeper shift. Approved in 1960, it brought continuous medication into the lives of healthy people. By the late 1960s and 1970s, tens of millions of women worldwide were taking hormones daily to regulate fertility and life planning rather than to treat illness. Contraceptives normalized long-term hormonal modulation when it served a clear, future-oriented purpose.

But GLP-1 receptor agonists are a different beast, representing a more foundational turn.

They are neither episodic like Viagra nor function-specific like contraceptives. They act continuously across appetite, metabolism, insulin signaling, inflammation, and cardiovascular risk—systems that define the baseline physiological state of the human organism. Their emerging role centers on maintaining a biological trajectory over time.

That difference matters. It marks a transition from medicine used occasionally or for specific functions to medicine that “stabilizes” the entire system —and, in doing so, begins to redefine what “normal” health means for many people.

The Race of Empires

Modern medicine is built around diseases and their diagnoses. Reimbursement, regulation, and clinical guidelines all assume discrete diseases with clear endpoints. GLP-1s do not quite fit that model, they act upstream, on the biological circuitry that influences many downstream outcomes at once.

Once the effects of GLP-1s became undeniable, the bottleneck moved upstream. Demand surged faster than any modern pharmaceutical supply chain was designed to handle.

By 2022, Novo Nordisk and Eli Lilly were no longer just competing on efficacy, the competition shifted to capacity. Both companies announced plans to spend tens of billions of dollars expanding manufacturing, a scale of capital investment rarely seen in drug development. Even so, supply lagged.

In the United States, the Food and Drug Administration placed multiple GLP-1 products on its official shortage list in 2022-2024, an extraordinary designation for drugs generating billions in annual revenue. These days, most of these shortages are resolved.

However, the shortage status changed the market “overnight”.

Federal rules at the time allowed compounding pharmacies to produce copies of approved drugs, while shortages persisted, opening a legal window that telehealth platforms moved through immediately.

Companies such as Noom, Ro, and Hims & Hers Health would offer compounded GLP-1s at prices hundreds of dollars below branded versions. Analysts estimated hundreds of thousands of users within months; executives claimed totals exceeding one million.

This was not a disruption in the classic startup sense. No new biology had been invented, the molecule already worked. But what changed was the access model. Cash-pay channels, online prescribing, and mail-order fulfillment removed friction faster than insurers or clinics could adapt. The result was a parallel distribution system operating alongside — and occasionally in tension with — the branded pharmaceutical market.

Drugmakers responded by tightening control.

Both Novo and Lilly pursued lawsuits over advertising practices and safety claims, while simultaneously building direct-to-consumer distribution channels and partnering selectively with telehealth platforms. The goal was clear: reclaim continuity before the market fragmented permanently.

At the same time, a second race unfolded inside research and development. Weekly injections had proven the point, but pills promised something bigger.

Oral formulations lowered psychological barriers, expanded global reach, and aligned with preventive use over decades rather than acute treatment. Whoever succeeded would not just capture market share, they would define how a population takes a drug meant to be used for years.

The first FDA-approved, daily oral GLP-1 receptor agonist specifically for chronic weight management in adults with obesity or overweight is the Wegovy pill (oral semaglutide), approved in December 2025 and launched in January 2026. It is the first pill version of the popular weekly injections, offering a daily, non-injectable option and what I think of as “an iPhone moment“ of the GLP-1 race.

Eli Lilly, in its turn, has orforglipron (LY3502970), a small-molecule, non-peptide oral GLP-1 receptor agonist in late-stage (Phase 3), designed for daily use without food restrictions. It is not yet on the market, but clinical trials showed significant weight loss up to 11.2% over 72 weeks.

The stakes extended beyond the companies themselves. National health systems, insurers, and employers watched a therapy that could plausibly reduce long-term cardiometabolic costs — and plausibly increase short-term spending at unprecedented scale. Coverage decisions became strategic bets on future disease curves rather than simple reimbursement choices.

By the time shortages began to ease, the market had already changed shape. Platforms had been built, habits had formed. Millions of users had started a therapy that evidence suggested would be difficult to stop without reversal.

What looked like a supply crisis was something deeper: the first sign that a drug acting on foundational metabolism would reorganize not just treatment pathways, but the institutions responsible for delivering care.

But recently, hints of an even bigger story started to emerge…

The Longevity Turn

During the Aging Research and Drug Discovery (ARDD) meeting in Copenhagen in 2025, I attended a presentation by Andrew Adams, Group Vice President of Molecule Discovery at Eli Lilly, where he presented a reframing that crystallized years of accumulating data. He argued that GLP-1 receptor agonists combine two properties rarely found together in medicine: mechanistic relevance to age-related disease and clinical scale sufficient to influence population-level healthspan.

The evidence supporting that claim was already familiar, though rarely assembled under a longevity lens. Trials showed reductions in progression from pre-diabetes to diabetes of up to 94%, significant declines in major adverse cardiovascular events, and sustained weight loss accompanied by improvements in inflammatory and metabolic markers.

They lower blood glucose and insulin resistance.

They suppress appetite and reduce caloric intake.

They slow gastric emptying, changing satiety timing.

They reduce inflammation and improve several cardiovascular risk markers.

Patients report improvements in blood pressure, lipid profiles, joint pain, sleep apnea symptoms, and energy levels.

Adams extended the argument further. He highlighted early signals linking GLP-1s to improvements in vascular function, cognitive trajectories, and psychiatric and addiction-related conditions, while emphasizing that these areas remain under active investigation.

The unifying theme was delay: delaying disease onset, delaying functional decline, and shifting risk curves later in life.

This framing placed GLP-1s within a broader transition already underway in healthcare. Preventive, proactive management gained priority over episodic intervention. Long-acting delivery formats entered the discussion recently, including RNA-based approaches and other technologies designed to sustain adherence across aging populations. The operational goal became continuity at scale.

A parallel message during the same ARDD2025 conference came from Lotte Bjerre Knudsen, Chief Scientific Advisor at Novo Nordisk and a central figure behind semaglutide. At the same conference, she opened her presentation with a direct title: “Semaglutide as a Proven Longevity Medicine.” The slide signaled how fully the internal scientific narrative had evolved alongside clinical results.

Together, these moments reframed the category. GLP-1s began to function as tools for managing long-term trajectories rather than addressing isolated conditions. Risk profiles over decades replaced short-term endpoints. Individual prescriptions scaled into population-level strategies tied to aging itself.

At this point, the implications settled into place. A therapy positioned to delay multiple age-related diseases simultaneously reshapes how healthcare systems plan, invest, and govern care across lifetimes. It turns prevention into infrastructure and metabolism into a managed domain.

Going from type 2 diabetes treatment to weight loss to systemic longevity management is an extraordinary shift… although many things are still to be proved in clinical trials.

Every medical miracle has a darker side…

As GLP-1 use moved from a clinical niche to mass adoption, the increasingly pressing question has become this:

“What does liability look like when a drug becomes baseline norm for tens (potentially hundreds) of millions of people, including relatively healthy ones?”

By late January 2026, about 4,400 lawsuits had been filed in the U.S. over GLP-1 drugs such as Ozempic, Wegovy, and Mounjaro (filings dating back to 2023), according to reporting that cited USA Today. The allegations span severe gastrointestinal injury and other serious harms—claims manufacturers deny and say they will fight in court.

Regulatory systems are optimized for therapies with clear indications and bounded time horizons. GLP-1s are drifting into a different category: continuous biological management. That changes the risk calculus in at least three ways:

1) Prevention lowers tolerance for harm.

When a therapy is used to reduce future risk rather than treat acute illness, tolerance for serious side effects drops sharply. Vaccines illustrate this dynamic well: they are judged less by potential benefit and more by how safely they shift long-term population risk. GLP-1s increasingly fall into a somewhat similar logic.

2) Rare events stop being rare at the population scale.

Even low-probability side effects become governance-level problems when the denominator is in the millions. That’s why regulators are updating guidance and surveillance, not just labeling.

In the UK, for example, the MHRA recently updated guidance on GLP-1 medicines and highlighted the risk of severe acute pancreatitis, noting 1,296 Yellow Card reports of pancreatitis (2007–Oct 2025) associated with GLP-1 receptor agonists. (They still emphasize the drugs are safe and effective for most people, but “most people” is not the relevant unit when systems manage scale.)

3) Population benefit vs. personal harm becomes the central political tension.

At the population level, GLP-1s may reduce cardiovascular events and delay metabolic disease, and even be the first “longevity drug” on the market. At the individual level, however, a subset of patients alleges devastating harm, and courts are where that asymmetry gets priced.

That tension is now being formalized in the structure of litigation itself. In December 2025, a federal judicial panel created a separate mass litigation to centralize lawsuits alleging GLP-1 drugs caused NAION-related vision loss, distinct from the existing GI injury litigation. Reuters reported nearly 3,000 lawsuits in the gastrointestinal MDL at that time, alongside dozens of vision-loss cases being centralized.

This is what “side effects” look like once a drug class becomes a pillar of preventive medicine: not just medical risk, but institutional risk, regulatory, legal, and reputational, accumulating alongside adoption.

So, what’s next?

A drug class that regulates metabolism at scale does more than change bodies. It reshapes how societies think about responsibility, aging, and care over a lifetime.

Doctors are already starting to treat GLP-1s as long-term drugs. For patients with obesity or metabolic disease, not being on one increasingly looks like an untreated risk rather than a neutral choice.

The same shift is happening on the money side. In the United States, big insurers like CVS Health, UnitedHealthcare, and major Blue Cross Blue Shield plans are running the numbers on what GLP-1s cost over a lifetime and what they might save by preventing heart attacks, diabetes, and other expensive diseases.

Coverage decisions now come down to whether paying more today reduces bigger bills later.

Employers are doing the same math. In the U.S., most workers are covered by self-insured employers, and those companies are deciding whether to pay for GLP-1s, how long to cover them, and who qualifies. Some limit duration. Some require people to try cheaper options first.

Benefits consultants are now part of the picture. Firms like Mercer, Aon, and Willis Towers Watson publish guidance on how GLP-1 coverage affects employer health spending and what trade-offs companies should expect.

Outside the United States, the same questions appear under different institutional names.

In the UK, the National Health Service evaluates GLP-1s through cost-effectiveness thresholds rather than employer budgets. The debate centers on whether long-term use justifies upfront spending when benefits accrue over decades.

Across Europe, national health systems face similar trade-offs. In countries like Germany and France, reimbursement discussions increasingly show up in the language of prevention economics: delayed diabetes, fewer cardiovascular events, and lower long-term disability costs weighed against continuous drug spending for large populations.

In Asia, the pressure comes from demographics. Aging populations in Japan, South Korea, and China drive interest in therapies that reduce metabolic and cardiovascular disease over time. Public and private payers are cautious, but the logic is familiar: long-term metabolic control looks cheaper than managing complications later. Access expands slowly, through pilot programs and narrow indications, rather than mass rollout.

Different systems, same problem.

For patients, the shift feels personal everywhere. Many people who stop these drugs see their weight and appetite return quickly. Over time, the question changes. It’s no longer “should I start?” It becomes “can I afford to stop?”

The gatekeepers of this new biology modulation era, institutions, companies, regulators, platforms, and employers, all are faced with effects that span decades and populations, they will have to figure out and build systems to manage continuity, risk, and global scale.

Thanks for reading. Please share it with those who may find it useful!

— Andrii

Good article, I’d add that the side effects of chronic multi-year administration of this class, has yet to be fully fleshed out (although the statins are, by and large, pretty safe for most people). Also the Novo trial for Semaglutide in Alzheimer’s Disease failed recently although I’ve only seen top-line data).